Master the most critical Greek in options trading and transform your trading strategy

Options trading can be incredibly profitable, but without understanding the fundamental Greeks, you’re essentially gambling with your money. Among all the Greeks, Delta stands as the most crucial metric that every options trader must master. If you don’t understand Delta, you’re setting yourself up for costly mistakes that could wipe out your trading account.

In this comprehensive guide, we’ll break down everything you need to know about Delta in options trading, using real-world examples and practical applications that will transform how you approach the options market.

What is Delta in Options Trading?

Delta is the rate of change of an option’s price given a one-dollar move in the underlying asset’s price. Think of it as the sensitivity meter for your options contracts. When the underlying stock moves by $1, Delta tells you exactly how much your option premium will change.

Here’s a simple example to illustrate this concept:

If you have an option with a Delta of 0.20, and the underlying stock moves up by $1, your option premium will increase by $0.20. Conversely, if the stock drops by $1, your option premium will decrease by $0.20.

This fundamental relationship forms the backbone of options pricing and is essential for calculating potential profits and losses on your trades.

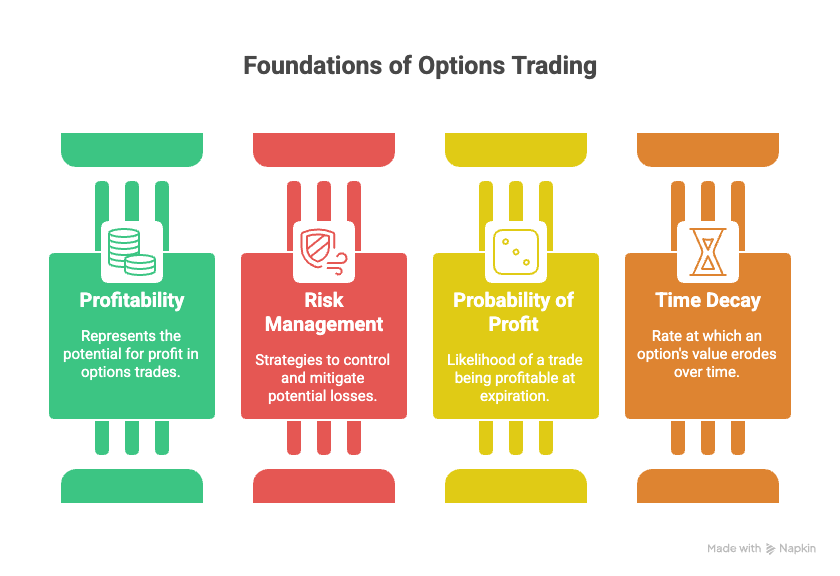

The Four Critical Ways Delta Impacts Your Options Trading

Understanding Delta isn’t just about knowing a definition – it’s about recognizing how this Greek affects every aspect of your options strategy. Delta influences four key areas:

1. Price Action and Premium Changes

Delta directly controls how your option premium responds to stock price movements. This sensitivity allows you to:

- Calculate potential profits before entering a trade

- Estimate losses if the trade moves against you

- Make informed decisions about position sizing

- Time your entries and exits more effectively

2. Directional Exposure and Market Sentiment

Delta reveals your market bias instantly. By looking at Delta values, you can determine whether a position is:

- Bullish (positive Delta)

- Bearish (negative Delta)

- Neutral (Delta close to zero)

This insight helps you align your positions with your market outlook and manage portfolio risk more effectively.

3. Probability Assessment

One of Delta’s most powerful features is its ability to approximate the probability that an option will expire in-the-money. This probabilistic interpretation helps you:

- Select appropriate strike prices

- Balance premium costs against profit potential

- Make more informed risk management decisions

4. Hedging Strategy Implementation

Delta is instrumental in creating effective hedging strategies. Whether you’re protecting existing stock positions or managing complex option spreads, Delta helps you calculate the exact hedge ratio needed for your risk tolerance.

Real-World Delta Example: Apple Stock Breakdown

Let’s walk through a practical example using Apple (AAPL) to see how Delta works in real trading scenarios.

Initial Setup:

- Apple stock price: $180

- Out-of-the-money call option premium: $0.50 ($50 per contract)

- Delta: 0.20

Scenario 1: Stock Price Increases

When Apple’s price moves from $180 to $181 (a $1 increase):

New option premium = $0.50 + $0.20 = $0.70

This represents a $20 gain per contract ($70 – $50 = $20), demonstrating how Delta amplifies your returns when the stock moves in your favor.

Scenario 2: Stock Price Decreases

When Apple’s price drops from $180 to $179 (a $1 decrease):

New option premium = $0.50 – $0.20 = $0.30

This results in a $20 loss per contract, showing how Delta can work against you when the stock moves in the wrong direction.

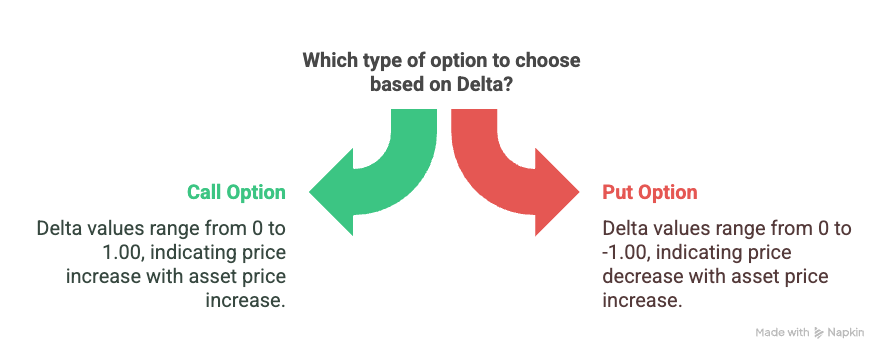

Understanding Positive vs. Negative Delta

Delta values can be positive or negative, and this distinction reveals crucial information about your position’s market exposure.

Positive Delta Positions

Positive Delta indicates bullish market sentiment:

- Call Buyers: When you buy calls, you want the market to move up. Your Delta will be positive (typically 0.01 to 1.00)

- Put Sellers: When you sell puts, you profit from upward or sideways movement. Your Delta will be positive

Also Read

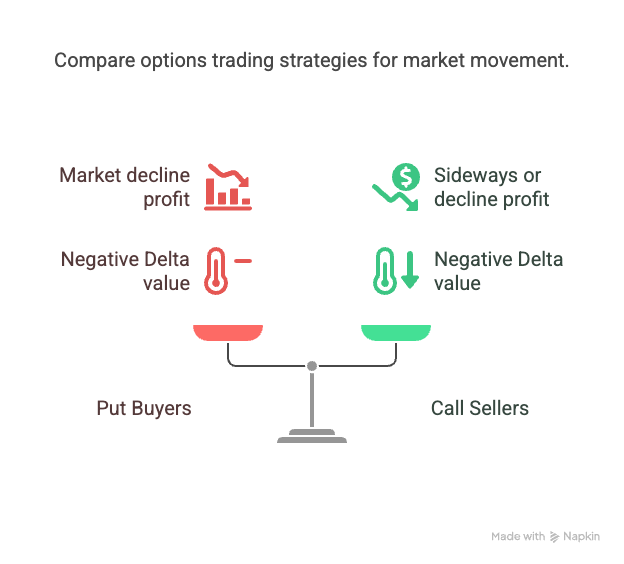

Negative Delta Positions

Negative Delta indicates bearish market sentiment:

- Put Buyers: When you buy puts, you want the market to move down. Your Delta will be negative (typically -0.01 to -1.00)

- Call Sellers: When you sell calls, you profit from downward or sideways movement. Your Delta will be negative

Delta as a Probability Indicator

One of the most valuable aspects of Delta is its role as a probability estimator. The Delta value approximates the percentage chance that an option will expire in-the-money.

For Options Buyers

If you’re buying a call with a Delta of 0.60, this suggests approximately a 60% chance that the option will finish in-the-money at expiration. Higher Delta values mean:

- Greater probability of profit

- Higher premium costs

- Less potential percentage returns but higher probability of success

For Options Sellers

If you’re selling options, you want lower Delta values because this increases the likelihood that the options will expire worthless, allowing you to keep the entire premium collected.

Key Strategy Points:

- Buyers prefer higher Delta (better chance of profit)

- Sellers prefer lower Delta (better chance of keeping premium)

- Delta helps balance risk vs. reward in strategy selection

Using Delta for Effective Position Hedging

Delta shines brightest when used for hedging existing positions. Here’s how to implement Delta-based hedging strategies:

The Covered Call Hedging Example

Imagine you own 100 shares of Apple stock with significant unrealized profits, but earnings are approaching and you’re concerned about potential downside.

Without Hedging:

- 100 shares of Apple at $180

- $1 stock move = $100 profit or loss

- Full exposure to market volatility

With Delta Hedging (Covered Call):

- Sell one out-of-the-money call with 0.30 Delta

- Collect premium upfront

- Reduce downside exposure by 30%

Hedging Calculation: If Apple drops $1, you lose $100 on the stock, but the call option premium decreases by $30 (0.30 Delta × $1 × 100 shares), which you keep as profit from selling the call.

Net loss: $100 – $30 = $70 (instead of the full $100)

This represents a 30% hedge of your position, determined by the Delta value of the option you sold.

Customizing Your Hedge Ratio

By selecting different Delta values, you can customize your hedging percentage:

- 0.20 Delta: 20% hedge (80% exposure remaining)

- 0.30 Delta: 30% hedge (70% exposure remaining)

- 0.50 Delta: 50% hedge (50% exposure remaining)

Advanced Delta Strategies for Different Market Conditions

High Volatility Environments

During earnings seasons or major economic events:

- Consider higher Delta options for directional plays

- Use lower Delta options for premium selling strategies

- Adjust hedge ratios based on expected volatility

Low Volatility Periods

When markets are calm:

- Focus on Delta-neutral strategies

- Sell higher Delta options for better premium collection

- Reduce hedging costs by using lower Delta protective options

Trending Markets

In strong trending environments:

- Align Delta exposure with trend direction

- Use Delta to scale into winning positions

- Implement trailing stops based on Delta changes

Common Delta Mistakes That Cost Traders Money

Mistake #1: Ignoring Delta When Buying Options

Many traders focus solely on potential returns without considering the probability (Delta) of success. Always balance potential reward with the likelihood of profit.

Mistake #2: Misunderstanding Delta Direction

Confusing positive and negative Delta can lead to positions that work against your market outlook. Always verify that your Delta aligns with your directional bias.

Mistake #3: Over-Hedging Positions

Using too high Delta values for hedging can eliminate most of your upside potential. Find the right balance between protection and profit potential.

Mistake #4: Neglecting Delta Changes

Delta isn’t static – it changes as the stock price moves and time passes. Monitor your positions regularly and adjust accordingly.

Key Takeaways for Successful Delta Trading

- Master the Definition: Delta measures option price sensitivity to $1 moves in the underlying asset

- Understand Directional Exposure: Positive Delta = bullish, Negative Delta = bearish

- Use Delta for Probability: Delta approximates the chance of expiring in-the-money

- Implement Smart Hedging: Use Delta to calculate precise hedge ratios for your risk tolerance

- Consider Market Context: Adjust Delta strategies based on volatility and market conditions

- Monitor Position Changes: Delta evolves with price and time – stay vigilant

Conclusion: Master Delta to Master Options Trading

Delta isn’t just another Greek to memorize – it’s the foundation of successful options trading. Whether you’re buying calls, selling puts, or implementing complex hedging strategies, Delta provides the crucial insights needed to make informed decisions.

By understanding how Delta affects option pricing, directional exposure, probability assessment, and hedging effectiveness, you’ll be equipped to navigate the options market with confidence and precision.

Remember: every successful options trader has mastered Delta. Those who ignore it often find themselves on the wrong side of probability, watching their trading accounts shrink while wondering what went wrong.

Start implementing these Delta concepts in your trading today, and you’ll quickly see the difference that proper Greek understanding makes in your overall profitability.

Ready to take your options trading to the next level? Subscribe to our channel for more in-depth options education and real-world trading strategies that work.

About the Author: This article is based on content from Ad Finance, a leading source of practical options trading education. For more trading insights and strategies, visit financewithad.com.

Disclaimer: Options trading involves substantial risk and is not suitable for all investors. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions.