The Pattern Day Trading (PDT) Rule can feel like a roadblock for active traders, especially those with margin accounts under $25,000. Introduced by the U.S. Securities and Exchange Commission (SEC) in 2001, this regulation aims to protect inexperienced traders from the risks of excessive day trading. In this article, we’ll break down what the PDT rule is, how it works, its consequences, and practical tips to avoid restrictions—all while keeping it clear and actionable for both new and seasoned traders. Whether you’re using Robinhood or another platform, this guide will help you navigate the PDT rule with confidence.

Table of Contents

- What Is the Pattern Day Trading Rule?

- What Counts as a Day Trade?

- Who Does the PDT Rule Apply To?

- Consequences of Breaking the PDT Rule

- Monitoring Day Trades on Robinhood

- Tips to Avoid PDT Restrictions

- Key Takeaways

- Conclusion

What Is the Pattern Day Trading Rule?

The PDT rule is a regulation set by the SEC in 2001 to safeguard new traders from the financial risks associated with frequent day trading. It applies specifically to margin accounts with balances under $25,000. Here’s how it works:

- If you execute four or more day trades within a rolling five-business-day period, your account is flagged as a pattern day trader.

- Once flagged, you must maintain a minimum balance of $25,000 in your margin account to continue day trading without restrictions.

- The rule excludes weekends and market holidays, focusing only on business days.

Why does this exist? The SEC aims to prevent inexperienced traders from overtrading, which can lead to significant losses, while maintaining market stability.

What Counts as a Day Trade?

A day trade occurs when you buy and sell (or sell and buy) the same security on the same trading day. Let’s clarify with two examples:

- Simple Example: You start the day with zero shares of Nvidia. At 10 a.m., you buy 100 shares, and at 2 p.m., you sell all 100 shares. This counts as one day trade.

- Complex Example: You start the day with 100 shares of Tesla. At 11 a.m., you sell 50 shares. At 1 p.m., you buy 50 shares back, and at 3 p.m., you sell the remaining 100 shares. This also counts as one day trade because it involves buying and selling the same stock within the same day.

Key takeaway: A day trade is defined by completing both a buy and sell of the same security on the same day, regardless of the number of transactions.

Who Does the PDT Rule Apply To?

The PDT rule applies only under specific conditions:

- Margin Accounts Under $25,000: If your margin account balance is below $25,000, you’re subject to the PDT rule and limited to three day trades in a five-business-day period.

- Exemptions:

- Margin Accounts Over $25,000: If you maintain a balance of $25,000 or more, you can day trade without restrictions, even if flagged as a pattern day trader.

- Cash Accounts: Cash accounts are completely exempt from the PDT rule, regardless of balance or trading frequency.

Understanding your account type and balance is crucial for determining whether the PDT rule affects your trading strategy.

Consequences of Breaking the PDT Rule

If you exceed three day trades in a five-business-day period with a margin account under $25,000, your broker will flag your account as a pattern day trader. Here’s what happens next:

- You must maintain a minimum of $25,000 in your account to continue day trading.

- If your balance falls below $25,000, your broker may impose restrictions, such as:

- Limiting you to closing existing positions only, preventing new trades.

- Restricting your account to cash-only trades for up to 90 days.

- Broker Flexibility: Most brokers, including Robinhood, offer a one-time warning or reset for first-time violations. However, repeated violations lead to stricter enforcement, and brokers may liquidate your positions to enforce the $25,000 minimum.

Pro Tip: Don’t rely on warnings—monitor your trades closely to avoid restrictions.

Monitoring Day Trades on Robinhood

Robinhood makes it easy to track your day trades and stay compliant with the PDT rule. Here’s how:

- Navigate to the Accounts and Investing section in the Robinhood app.

- Scroll to the Day Trades section, which displays a clear count of your day trades within the rolling five-business-day period.

- If you’re close to the limit (e.g., two or three day trades), Robinhood will show you how many trades remain before you risk breaking the rule.

This feature is especially helpful for new traders to avoid accidental violations. Other platforms often have similar tools, so check your broker’s interface for day trade tracking.

Tips to Avoid PDT Restrictions

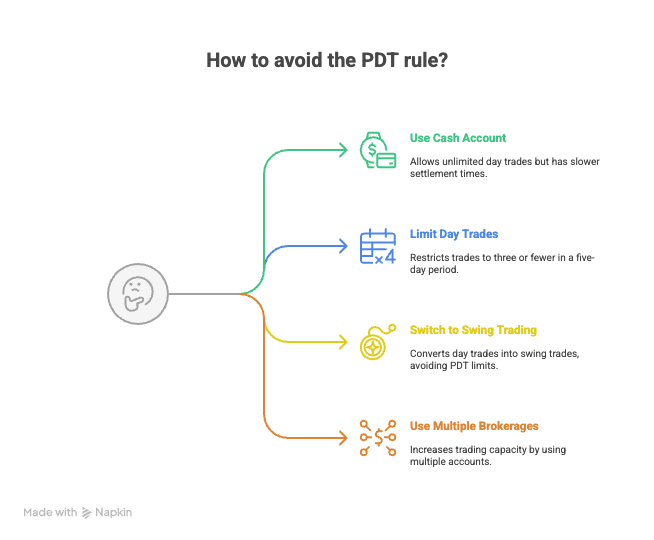

Here are four practical strategies to avoid PDT rule limitations:

- Use a Cash Account: Cash accounts are exempt from the PDT rule, allowing unlimited day trades. However, note that cash accounts have slower settlement times (T+2 for stocks).

- Limit Day Trades: If using a margin account under $25,000, keep your day trades to three or fewer in any rolling five-day period.

- Switch to Swing Trading: Hold positions overnight to convert day trades into swing trades, which don’t count toward the PDT limit.

- Use Multiple Brokerages: Spread your day trades across different brokerage accounts (e.g., Robinhood, Fidelity, Webull). Each brokerage has its own three-trade limit, effectively increasing your trading capacity.

Note: While using multiple brokerages is a workaround, it’s not always practical due to the complexity of managing multiple accounts. Use this strategy cautiously.

Key Takeaways

- The PDT rule applies to margin accounts under $25,000, limiting traders to three day trades in a five-business-day period.

- A day trade involves buying and selling the same security on the same day, and even complex transactions can count as a single day trade.

- Breaking the PDT rule can lead to trading restrictions or forced liquidation if you don’t maintain a $25,000 balance.

- Use broker tools like Robinhood’s day trade counter to stay compliant, and consider strategies like cash accounts or swing trading to avoid restrictions.

- Brokers may offer a one-time warning, but repeated violations result in stricter enforcement.

Conclusion

The Pattern Day Trading rule can seem daunting, but with the right knowledge and strategies, you can trade confidently while staying compliant. By understanding what counts as a day trade, monitoring your activity with platform tools, and leveraging workarounds like cash accounts or swing trading, you can maintain flexibility in your trading approach. Whether you’re a beginner or an experienced trader, mastering the PDT rule is essential for avoiding costly penalties and keeping your trading journey smooth.

Have questions about the PDT rule or other trading topics? Drop them in the comments below, and don’t forget to subscribe to get your free copy of options trading. Stay tuned for upcoming posts on options trading and live trading sessions!

Happy trading, and see you in the next post!