When it comes to options trading, most beginners focus heavily on Delta and Theta – the two most popular Greeks. However, there’s another crucial Greek that’s often overlooked but can be incredibly profitable when understood correctly: Vega. In this comprehensive guide, we’ll break down everything you need to know about Vega, how it impacts option prices, and most importantly, how you can use it to generate consistent profits.

What is Vega in Options Trading?

Vega measures the sensitivity of an option’s price to changes in implied volatility (IV). In simple terms, Vega tells you how much an option’s value will change for every 1% movement in implied volatility.

Here’s a practical example to illustrate this concept:

- Stock price: $100

- Current implied volatility: 20%

- Option Vega: 0.25 (25 cents)

If the implied volatility increases from 20% to 21% (a 1% increase), the option’s price will increase by $0.25. Conversely, if IV decreases by 1%, the option loses $0.25 in value.

This relationship makes Vega particularly important for traders who want to profit from volatility changes rather than just price movements.

Key Characteristics of Vega

1. Vega Moves with Implied Volatility

Unlike other Greeks that remain relatively stable, Vega is dynamic and closely tied to implied volatility levels. This creates an interesting phenomenon:

- High volatility stocks (like biotech or tech companies around earnings) have high Vega values

- Stable stocks (like utilities such as AT&T) have low Vega values because their implied volatility remains consistently low

This relationship is crucial because it means Vega opportunities aren’t equal across all stocks. You’ll find the most significant Vega plays in volatile securities.

2. Time to Expiration Affects Vega

Longer-dated options have higher Vega than shorter-term options. This makes sense when you think about it:

- 6-month options: More time for volatility to impact the option’s value = Higher Vega

- Weekly options: Less time for volatility changes to matter = Lower Vega

This characteristic is essential for traders planning volatility-based strategies, as longer expiration dates provide more Vega exposure.

3. Moneyness Impact on Vega

At-the-money (ATM) options exhibit the highest Vega values, while out-of-the-money (OTM) options have lower Vega. Here’s why:

- ATM options: Highest sensitivity to volatility changes because small IV shifts can significantly impact whether the option expires in-the-money

- Deep OTM options: Lower Vega because the probability of expiring in-the-money is already low, making them less sensitive to volatility changes

How to Profit from Vega: The IV Crush Strategy

Now comes the exciting part – how to actually make money using Vega. The most reliable Vega-based strategy revolves around a phenomenon called IV Crush.

Understanding IV Crush

IV Crush occurs when implied volatility drops dramatically after a significant event, most commonly earnings announcements. Here’s the typical pattern:

- Pre-earnings: IV increases as uncertainty grows

- Earnings announcement: IV reaches peak levels

- Post-earnings: IV crashes regardless of stock direction

If you prefer a video format then watch video on my youtube channel AD Finance

The Vega Profit Strategy

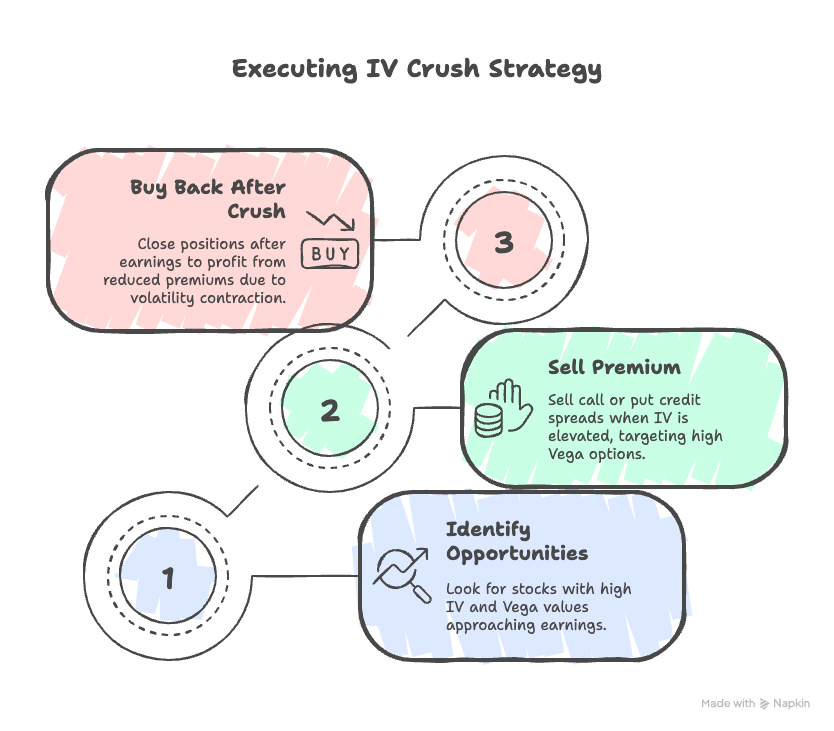

As an option seller, you can exploit this predictable pattern:

Step 1: Identify High IV Opportunities

- Look for stocks approaching earnings with IV above 80-100%

- Check earnings calendars (like Nasdaq’s earnings calendar)

- Focus on stocks with historically high Vega values

Step 2: Sell Premium at High IV

- Sell call credit spreads or put credit spreads when IV is elevated

- Target options with high Vega exposure

- Time your entry 2-7 days before earnings

Step 3: Buy Back After IV Crush

- Close positions 1-2 days after earnings announcement

- Profit from the reduced option premiums due to Vega decline

- Your profit comes from volatility contraction, not price movement

Real-World Example: CrowdStrike Earnings Play

Let’s examine a practical example using CrowdStrike (CRWD) before earnings:

- Pre-earnings IV: 105% (extremely high)

- ATM Put Vega: 1.20

- Strategy: Sell put credit spread

If IV drops by 30% post-earnings (from 105% to 75%), each contract would lose approximately $36 in extrinsic value (30% × $1.20 Vega). As the option seller, this becomes your profit.

Advanced Vega Trading Considerations

1. Vega and Different Option Strategies

- Long options: Positive Vega exposure (benefit from IV increases)

- Short options: Negative Vega exposure (benefit from IV decreases)

- Spreads: Vega exposure depends on strike selection and expiration

2. Managing Vega Risk

- Position sizing: Limit Vega exposure to manageable levels

- Diversification: Don’t concentrate all trades in high-Vega positions

- Exit planning: Have clear rules for when to close Vega-dependent trades

3. Market Conditions and Vega

Vega effectiveness varies with market conditions:

- High VIX environments: More Vega opportunities available

- Low VIX periods: Limited Vega-based profit potential

- Trending markets: Directional bias may override Vega effects

Does Vega Really Matter? Priority in Options Trading

Here’s the honest truth about Vega’s importance in your trading hierarchy:

Primary Focus: Delta and Theta

For most traders, especially beginners, Delta and Theta should be your primary focus:

- Delta: Manages directional risk and profit potential

- Theta: Critical for income-generating strategies

Secondary Focus: Vega

Vega becomes important in specific scenarios:

- Event-driven trades (earnings, FDA approvals, etc.)

- Volatility trading strategies

- Advanced portfolio hedging

The Bottom Line

Master Delta and Theta first. Once you’re consistently profitable with these Greeks, then incorporate Vega strategies into your toolkit. Don’t let Vega complexity distract from fundamental options trading principles.

Common Vega Mistakes to Avoid

- Overemphasizing Vega: Don’t ignore Delta and Theta for Vega opportunities

- Timing errors: Entering IV crush trades too early or too late

- Ignoring fundamentals: High IV doesn’t always mean profitable Vega trades

- Poor risk management: Vega can work against you in volatile markets

Tools and Resources for Vega Trading

Recommended Platforms

- Robinhood: Basic Vega display for retail traders

- Think or Swim: Advanced Greeks analysis

- Tastytrade: Specialized options analytics

Key Metrics to Monitor

- Current implied volatility levels

- Historical volatility comparison

- Vega values across strike prices

- Days to expiration impact

Conclusion: Making Vega Work for You

Vega presents unique profit opportunities for informed options traders, particularly through IV crush strategies around earnings events. However, it’s crucial to maintain perspective – Vega is a supplementary tool, not a primary trading focus.

Key takeaways for successful Vega trading:

- Understand the mechanics: Know how IV changes affect option prices

- Focus on high-probability setups: Target predictable IV crush events

- Maintain proper priorities: Master Delta and Theta before emphasizing Vega

- Practice risk management: Vega can create both profits and losses

- Stay patient: The best Vega opportunities come to those who wait for ideal setups

By incorporating these Vega principles into your options trading strategy, you’ll have another powerful tool for generating consistent profits in the options market.

1 thought on “Options Greek Vega Explained Beginner Friendly”