Learn the exact put credit spread strategy that can generate consistent weekly income even with limited capital

Introduction: Growing Small Trading Accounts the Smart Way

Are you tired of watching your small trading account grow at a snail’s pace? What if I told you there’s a proven options strategy that could help you generate $200-$300 every single week, even with limited capital?

In this comprehensive guide, I’ll walk you through the exact small account options trading strategy that transforms the traditional cash-secured put approach into a capital-efficient powerhouse. This isn’t about risky gambling – it’s about using smart position sizing and risk management to build wealth consistently.

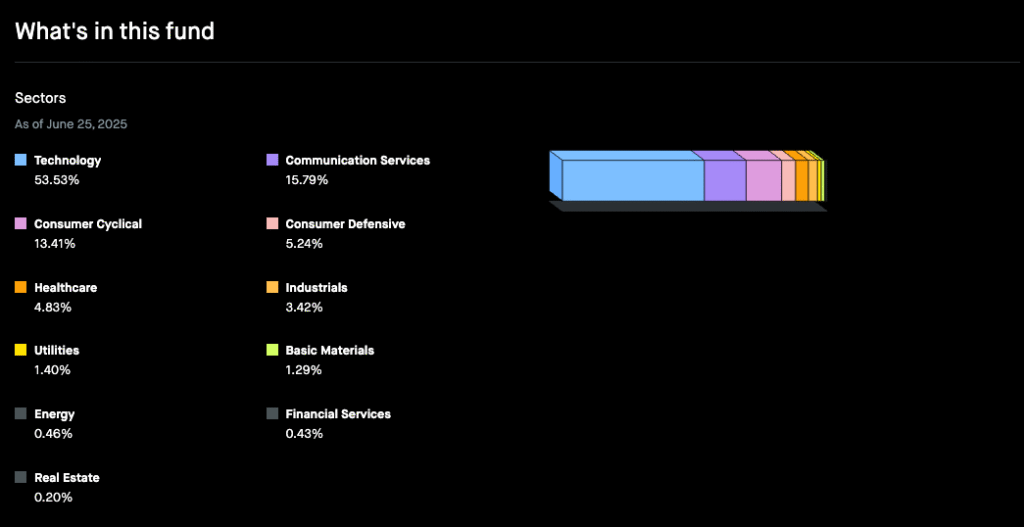

Why QQQ ETF is Perfect for Small Account Trading

The Power of Diversification

The foundation of this strategy centers around the QQQ ETF, which tracks the NASDAQ 100. Here’s why this makes perfect sense for small accounts:

- Instant diversification across major technology companies

- Daily options availability for maximum flexibility

- Lower implied volatility compared to individual stocks (reducing extreme price swings)

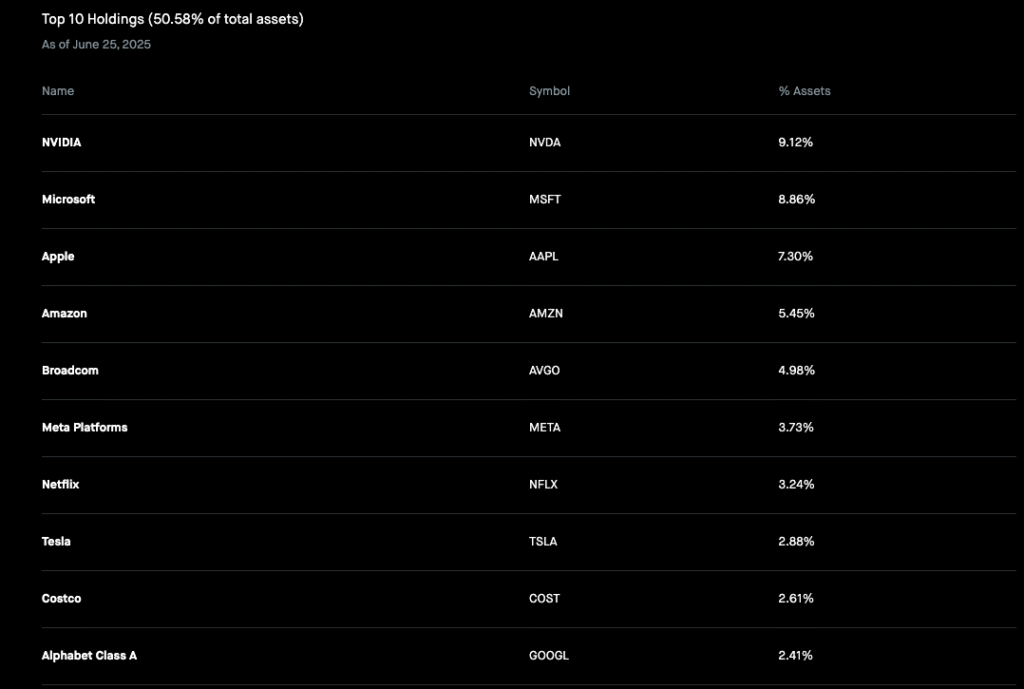

- Top holdings include Apple, Microsoft, Amazon, and other tech giants

When you trade QQQ options, you’re essentially getting exposure to the entire tech sector without the individual stock risk that could wipe out a small account overnight.

The Traditional Cash-Secured Put Problem

Before diving into our solution, let’s understand why traditional strategies don’t work for small accounts.

If you wanted to sell a cash-secured put on QQQ at a $370 strike price, you’d need approximately $37,000 in your account as collateral. That’s because you need to have enough cash to purchase 100 shares if assigned.

For most small account traders, this capital requirement makes the strategy completely inaccessible. But here’s where our approach changes everything.

The Game-Changing Put Credit Spread Strategy

What is a Put Credit Spread?

A put credit spread involves two simultaneous actions:

- Selling a put option at a higher strike price (collecting premium)

- Buying a put option at a lower strike price (limiting maximum loss)

This combination dramatically reduces your capital requirement while capping your maximum risk.

[Suggested Image: Diagram showing put credit spread structure with strike prices and profit/loss zones]

Step-by-Step Strategy Execution

Step 1: Select Your Expiration Date

- Choose weekly options for optimal balance

- Avoid daily expirations (too much management required)

- Weekly contracts provide sufficient time decay while limiting exposure

Step 2: Choose Your Strike Price Using Delta

The most critical factor in strike selection is the delta value. Here’s what you need to know:

- Target a delta around 30

- 30 delta means only a 30% probability of expiring in-the-money

- This gives you a 70% chance of keeping the full premium

For example, if QQQ is trading around $375, a $369 strike might have a delta close to 30, making it ideal for our strategy.

Step 3: Buy Protection Below

After selling your put, buy a put option approximately 3 points lower:

- If you sold the $369 put, buy the $366 put

- This creates your spread and caps maximum loss

- Going too close reduces premium; going too far increases risk

The Numbers That Will Shock You

Let’s compare the capital requirements:

Traditional Cash-Secured Put:

- Capital Required: $37,000

- Premium Collected: ~$70

- Return on Investment: 0.19%

Put Credit Spread:

- Capital Required: $250

- Premium Collected: ~$67

- Return on Investment: 26.8%

The difference is staggering. You’re getting nearly the same premium income with 148 times less capital required!

Risk Management: Your Safety Net

Maximum Loss is Always Capped

Unlike naked put selling, your maximum loss is limited to: Maximum Loss = (Strike Price Difference – Premium Received)

In our example:

- Strike difference: $369 – $366 = $300

- Premium received: $67

- Maximum loss: $233

This capped risk is crucial for small accounts because it prevents catastrophic losses that could wipe out months of progress.

Implied Volatility Considerations

For QQQ, implied volatility typically ranges between 15-25%. While this is lower than individual stocks, it’s sufficient for our strategy because:

- Lower volatility means more predictable price movements

- Reduced chance of extreme moves against your position

- More consistent premium collection opportunities

When This Strategy Works Best

Market Conditions for Success

This put credit spread strategy thrives in:

- Neutral markets with sideways movement

- Mild uptrending markets

- Consolidation phases

The strategy struggles during:

- Sharp market downturns

- High volatility periods

- Strong trending moves below your strike

Scaling Your Success: The Compounding Effect

Monthly Profit Potential

With consistent execution, here’s what’s possible:

- Weekly profit: $67

- Monthly profit: ~$268 (4 weeks)

- Annual potential: $3,484

But here’s where it gets exciting – as your account grows, you can increase position size:

Month 1: 1 contract = $268 profit

Month 6: 2 contracts = $536 profit

Month 12: 4 contracts = $1,072 profit

[Suggested Image: Compound growth chart showing account progression over 12 months]

Common Mistakes to Avoid

1. Wrong Delta Selection

- Don’t go too aggressive with delta >40

- Avoid being too conservative with delta <20

2. Poor Timing

- Don’t trade during high-stress market events

- Avoid earnings weeks for ETFs

3. Position Sizing Errors

- Never risk more than 2-3% of account per trade

- Don’t increase size too quickly

Advanced Tips for Optimization

Premium Enhancement Strategies

- Time your entries when IV is elevated

- Roll positions before expiration if profitable

- Use limit orders to improve fill prices

Position Management

- Close positions at 50% max profit when possible

- Don’t hold until expiration unless necessary

- Have a plan for assignment scenarios

Real-World Example Walkthrough

Let’s walk through a complete trade. If you are comfortable more on showing me this trade in a video format then I recommend you this video where I show this trade setup :

Setup:

- QQQ trading at $375

- Sell $369 put (30 delta)

- Buy $366 put

- Premium collected: $67

- Capital required: $250

Outcome Scenarios:

Scenario 1 (70% probability): QQQ closes above $369

- Result: Keep full $67 premium

- ROI: 26.8%

Scenario 2: QQQ closes between $366-$369

- Result: Partial loss, but less than max

- Management: Close position or roll to next week

Scenario 3 (Low probability): QQQ closes below $366

- Result: Maximum loss of $233

- Learning: Adjust strategy or wait for better market conditions

Building Your Trading Plan

Weekly Routine

- Monday: Analyze market conditions and IV levels

- Tuesday: Enter new positions if conditions align

- Wednesday-Thursday: Monitor positions, plan adjustments

- Friday: Close profitable positions, prepare for next week

Record Keeping

Track every trade with:

- Entry and exit dates

- Strike prices and premiums

- Market conditions

- Lessons learned

Frequently Asked Questions

Can I Use This Strategy with Individual Stocks?

Yes, but look for stocks with higher implied volatility (20-30%) to collect better premiums. The same delta principles apply.

What if I Get Assigned?

Assignment means you’ll own 100 shares of QQQ at your strike price. You can either hold the shares or sell them immediately, depending on your outlook.

How Much Capital Do I Need to Start?

While each spread requires about $250, I recommend starting with at least $2,500 to manage 2-3 positions safely while maintaining proper risk management.

Conclusion: Your Path to Consistent Weekly Income

This small account options trading strategy offers something rare in the trading world: a systematic approach to generating consistent income with capped risk. By using QQQ put credit spreads with proper delta selection and risk management, you can potentially earn $200-$300 weekly while building your account steadily.

Remember, success in options trading comes from consistency, proper risk management, and continuous learning. Start small, master the basics, and gradually scale your positions as your account and confidence grow.

The beauty of this strategy lies not just in its profit potential, but in its accessibility to traders with limited capital. You’re no longer locked out of income-generating strategies due to high capital requirements.