The financial world witnessed a seismic shift when Robinhood unveiled its most ambitious crypto expansion at their inaugural European keynote in the French Riviera. This comprehensive analysis breaks down every major announcement and what it means for the future of digital investing.

Robinhood’s European Crypto Revolution: 31 Countries Now Live

Robinhood has officially launched its crypto app across the entire European Union and European Economic Area, bringing their platform to 31 countries total. This massive expansion marks a pivotal moment in cryptocurrency accessibility, particularly given the regulatory clarity now available in Europe.

Key Expansion Highlights:

- Complete EU/EEA Coverage: All 27 EU countries plus 4 EEA nations

- Regulatory Advantage: Leveraging Europe’s clear crypto regulations vs. uncertain US framework

- Mobile-First Approach: Optimized for smartphone trading experiences

The timing couldn’t be better, as European regulators have provided the clarity that crypto companies desperately needed to innovate and expand their offerings.

Perpetual Futures Trading: Mobile-First Innovation

One of the most significant announcements was the introduction of perpetual futures trading, specifically designed for mobile users. Traditional crypto derivatives platforms have notoriously complex interfaces, often requiring 20+ clicks to place a single order.

Revolutionary Features:

- Intuitive Slider Controls: Adjust position sizes with simple gestures

- Real-Time P&L Ladder: Visual profit/loss tracking with swipe controls

- Up to 3X Leverage: Accessible to both novice and advanced traders

- Bitstamp Integration: Powered by the world’s longest-running crypto exchange

This mobile-first approach addresses a critical barrier to crypto adoption – complexity. By making derivatives trading as simple as buying spot crypto, Robinhood is democratizing access to institutional-grade financial instruments.

US Market Updates: Advanced Trading Tools Arrive

American users aren’t being left behind. Robinhood announced several major upgrades specifically for US customers:

Advanced Charting on Mobile

- Professional-grade indicators

- Direct chart trading capabilities

- No additional fees for premium features

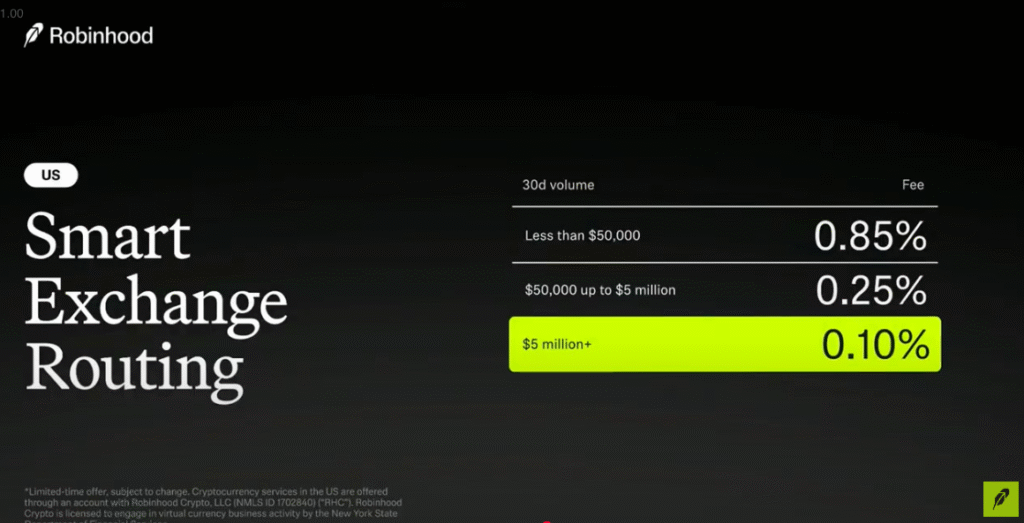

Smart Exchange Routing

- Best price execution across multiple exchanges

- Volume-based fee tiers (as low as 10 basis points)

- Rolling 30-day volume calculations

Tax-Optimized Trading

- Choose specific crypto holdings when selling

- Better capital gains/loss management

- Industry-first feature among major platforms

AI Investment Assistant “Cortex”

- Real-time market analysis

- Event-driven insights

- Contextual news and trends

Staking Services Launch

- Ethereum and Solana staking available

- Competitive APY rates

- 2% deposit bonus through July 7th

Stock Tokens: The Future of Tokenized Trading

Perhaps the most groundbreaking announcement was the launch of stock tokens – tokenized versions of US stocks and ETFs available to European customers.

How Stock Tokens Work:

Phase 1 (Current): Traditional Custody with Token Representation

- US broker purchases actual shares

- Tokens minted 1:1 with real stock holdings

- 24/5 trading availability

- Zero commission trading

Phase 2 (Coming Soon): Dual Market Trading

- Integration with Bitstamp exchange

- True 24/7 trading capabilities

- Choice between traditional and crypto markets

- Enhanced liquidity options

Phase 3 (Future): Full Blockchain Integration

- Self-custody capabilities

- DeFi integration potential

- Direct blockchain interaction

- Complete decentralization

Investment Advantages:

- Zero Commissions: No trading fees on stock tokens

- Dividend Payments: Full dividend rights maintained

- ETF Access: Popular funds like VOO and SPY available

- Low FX Fees: Only 0.10% currency conversion cost

Robinhood Chain: Building the Financial Infrastructure of Tomorrow

The announcement of Robinhood Chain represents the company’s long-term vision for a blockchain optimized specifically for real-world assets.

Technical Specifications:

- Purpose-Built: Designed for traditional asset tokenization

- Regulatory Compliant: Built with compliance frameworks

- Interoperable: Supporting various asset classes

- Developer Friendly: Open ecosystem for innovation

Potential Applications:

- Real estate tokenization

- Art and collectibles

- Private equity access

- Commodities trading

- Traditional securities

This infrastructure could become the backbone for the next generation of financial markets, where any asset can be tokenized, traded, and accessed globally.

Historic Private Company Token Distribution

In an unprecedented move, Robinhood announced the world’s first distribution of tokenized private company shares, specifically OpenAI and SpaceX tokens to European customers.

Significance of This Development:

- Market Access: Previously exclusive investments now accessible

- Wealth Democratization: Breaking down barriers to private markets

- Regulatory Innovation: Setting precedent for private equity tokenization

- Technology Demonstration: Proving concept for future expansions

This distribution serves as both a marketing initiative and a proof-of-concept for how blockchain technology can democratize access to high-value private investments.

Regulatory Landscape and Market Implications

The keynote highlighted a crucial shift in global crypto regulation, with Europe leading the charge in providing clear frameworks while the US continues to lag behind.

European Advantages:

- MiCA Regulation: Comprehensive crypto asset regulation

- Innovation Support: Clear guidelines enabling new products

- Stable Coin Clarity: USDG approved under new regulations

- Market Confidence: Reduced regulatory uncertainty

US Challenges:

- Regulatory Uncertainty: Ongoing legal battles and unclear frameworks

- Innovation Limitations: Delayed product launches due to compliance concerns

- Competitive Disadvantage: Risk of falling behind European innovation

Investment Strategy Implications

These developments create several new investment opportunities and strategies:

For European Investors:

- Diversified Exposure: Access to US markets without traditional barriers

- 24/7 Trading: Flexibility to trade around the clock

- Cost Efficiency: Zero commission trading with minimal FX fees

- Private Market Access: Early exposure to high-growth private companies

For US Investors:

- Advanced Tools: Professional-grade features on mobile

- Cost Optimization: Volume-based fee structures

- Tax Efficiency: Better capital gains management

- Passive Income: Staking rewards from crypto holdings

For Global Markets:

- Technology Adoption: Proof of tokenization viability

- Regulatory Precedent: Models for other jurisdictions

- Market Efficiency: 24/7 trading capabilities

- Asset Innovation: New forms of investment vehicles

Technical Analysis: Market Impact and Future Projections

[Suggested Image: Chart showing potential market growth with tokenization adoption]

The technical infrastructure being built by Robinhood could have far-reaching implications for global financial markets:

Short-Term Impact (6-12 months):

- Increased crypto adoption in Europe

- Enhanced trading volumes on tokenized assets

- Competitive pressure on traditional brokers

- Regulatory clarity driving innovation

Medium-Term Impact (1-3 years):

- Widespread tokenization of traditional assets

- Integration with DeFi protocols

- Global expansion of similar services

- Traditional finance blockchain adoption

Long-Term Impact (3-5 years):

- Complete transformation of asset trading

- Decentralized financial infrastructure

- Global 24/7 market operations

- New asset classes and investment vehicles

Risk Assessment and Considerations

While these developments are exciting, investors should consider several risk factors:

Technology Risks:

- Smart contract vulnerabilities

- Blockchain network issues

- Custody security concerns

- Platform dependency risks

Regulatory Risks:

- Changing legal frameworks

- Cross-border compliance issues

- Tax implications uncertainty

- Enforcement variations

Market Risks:

- Liquidity concerns for new assets

- Price volatility in tokenized markets

- Correlation with underlying assets

- Market manipulation potential

Expert Opinion: Why This Matters for Investors

As someone who’s been analyzing financial markets and crypto developments for years through my Ad Finance channel, I believe these announcements represent a fundamental shift in how we’ll interact with financial markets in the future.

The combination of regulatory clarity, technological innovation, and user experience improvements creates a perfect storm for mainstream crypto adoption. What’s particularly impressive is how Robinhood has maintained simplicity while introducing sophisticated financial instruments.

The tokenization of private company shares is especially significant – it could be the catalyst that finally brings institutional-grade investments to retail investors globally.

Conclusion: The Dawn of Tokenized Finance

Robinhood’s European expansion and tokenization initiatives mark more than just product launches – they represent the beginning of a new era in finance. By combining the accessibility of mobile trading with the power of blockchain technology, Robinhood is creating infrastructure that could reshape global financial markets.

For investors, these developments offer unprecedented opportunities to diversify portfolios, access previously exclusive assets, and participate in the global economy 24/7. However, as with any emerging technology, due diligence and risk management remain crucial.

The financial world is evolving rapidly, and platforms like Robinhood are leading the charge toward a more accessible, transparent, and efficient future for all investors.

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Always consult with qualified financial advisors before making investment decisions.